|

I have extensively covered how to trade for capital gains in the stock exchange, in my series “LEARN TO TRADE IN THE STOCK EXCHANGE” and in the stand alone article “THREE EASY METHODS TO TRADING PENNY STOCKS FOR QUICK PROFITS”. When you trade stocks based on price per share you are making capital gains and that is the easiest way to make quick profits (of course trading is not absent of its own risks). The purpose of this installment is to get you familiarized with dividend yielding stocks and how you can utilize them in your portfolio not only for growth, but for creating a residual income stream from paper assets.

|

An Investment Win Win Opportunity

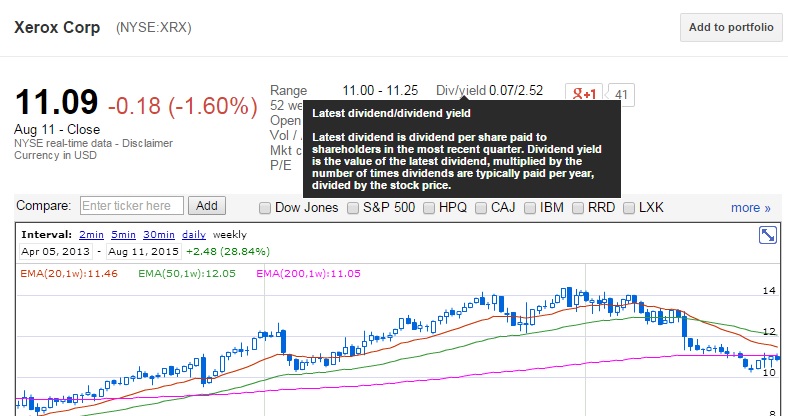

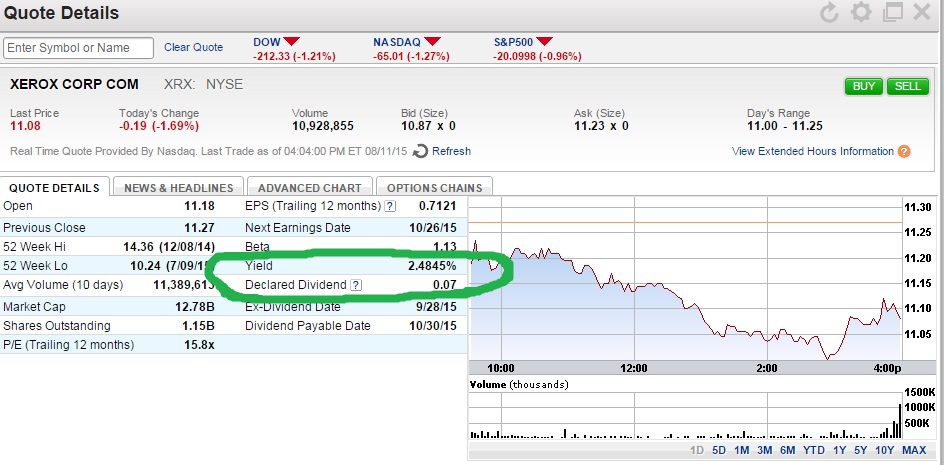

The appeal of dividend paying stocks is that, as a shareholder, you have the potential to receive a portion of the company’s revenue in the form of a dividend payment. This is a form of profit sharing that companies offer to attract investor capital. Not all stocks pay a dividend and what you are looking for when screening the market for investment opportunities are two specific criteria under the ticker symbol for a company’s stock. That is the “DIV (Latest dividend paid per share)” and the “YIELD (the latest ROI calculation *annualized)”. The following photos show a couple references of where you would find this information:

The appeal of dividend paying stocks is that, as a shareholder, you have the potential to receive a portion of the company’s revenue in the form of a dividend payment. This is a form of profit sharing that companies offer to attract investor capital. Not all stocks pay a dividend and what you are looking for when screening the market for investment opportunities are two specific criteria under the ticker symbol for a company’s stock. That is the “DIV (Latest dividend paid per share)” and the “YIELD (the latest ROI calculation *annualized)”. The following photos show a couple references of where you would find this information:

The “win win” opportunity that dividend stocks can provide an individual building an investment portfolio is in growth potential and residual income. Probably the most common pro-growth strategy for building an investment portfolio, for example, is to find dividend paying stocks within a prospering sector of the markets, with a proven track record of positive earnings and upside potential in share price. Once some positions are taken, one could continue to add to their positions by “buying the dip”, if the stock price continues an upward trend, and this will not only increase the number of shares to earn dividends on but the overall equity of the investment portfolio. Some may choose to combine capital gain trading strategy with dividend yield earnings, and remain mostly liquid, and that requires a sense of timing. You don’t need to hold dividend earning stocks for an entire fiscal quarter in order to earn them.

Three Key Dates for Dividend Earning Stocks

Stocks that pay a dividend to shareholders usually release several newsletters prior to filing their quarterly earnings report. As a trader there are only three key dates that you must keep in mind if you are to be eligible to earn dividends on your shares for the fiscal quarter:

Three Key Dates for Dividend Earning Stocks

Stocks that pay a dividend to shareholders usually release several newsletters prior to filing their quarterly earnings report. As a trader there are only three key dates that you must keep in mind if you are to be eligible to earn dividends on your shares for the fiscal quarter:

- Date of Declaration - the date of declaration is when the company declares what (if any) and when they will be paying shareholders a quarterly dividend. This is usually when the Ex-Dividend date is given, as well.

- Ex-Dividend Date – this date typically marks the final trading day to get shares from the company and still be eligible for quarterly dividend earnings. Trades require three days to fully process (T+3).

- Date of Record – this is the day you must show up on the company’s books as a shareholder (trades must already be processed prior to this date) in order to be eligible for the quarter’s dividend payment.