I am going to share exactly how I have been testing, practicing, and perfecting my personal method for trading stocks without putting a dime of my capital at risk! You will need a Gmail account in order to use Google finance, and save your portfolio. A portfolio will help you learn how to trade by letting you perform paper trades with full control over your account, and keeping track of each transaction you make for your record. Paper trading is when you trade without using actual cash (think of it like a video game version of trading).

Learn How to Earn without the Risk of Getting Burned

The following figures will guide you step by step, from setting up your portfolio to making a trade:

1. Starting a New Paper Trading/Stock Watch Portfolio

The following figures will guide you step by step, from setting up your portfolio to making a trade:

1. Starting a New Paper Trading/Stock Watch Portfolio

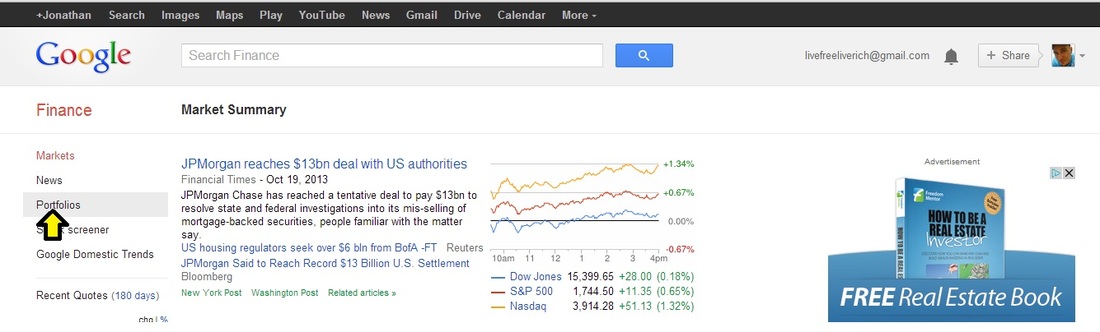

Figure 1-A

1. Sign in to your Gmail account at http://www.Google.com

2. Go to http://www.Google.com/finance

3. Click on “Portfolios”

1. Sign in to your Gmail account at http://www.Google.com

2. Go to http://www.Google.com/finance

3. Click on “Portfolios”

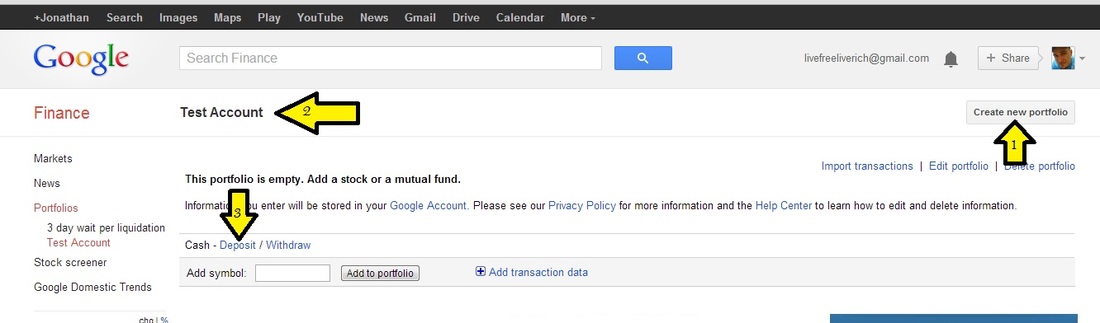

Figure 1-B

1. Click “Create New Portfolio” in the upper right corner. (Chrome browser)

2. Name your portfolio

First thing you want to do when you open your “trading” account is to fund it. Click “deposit” and set your starting amount for the account’s trading capital.

1. Click “Create New Portfolio” in the upper right corner. (Chrome browser)

2. Name your portfolio

First thing you want to do when you open your “trading” account is to fund it. Click “deposit” and set your starting amount for the account’s trading capital.

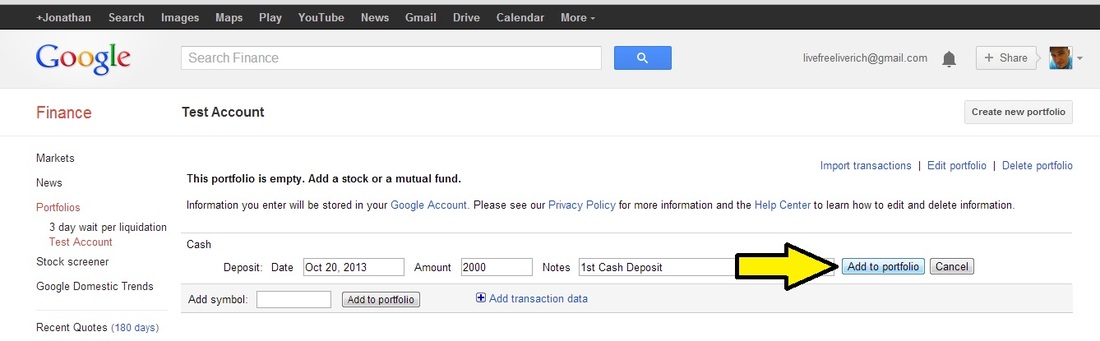

Figure 1-C

When you click deposit, a drop down entry form will come up. This is going to be recorded as your accounts first transaction. Once you click add to portfolio, the “cash” will be available to use towards your trades.

When you click deposit, a drop down entry form will come up. This is going to be recorded as your accounts first transaction. Once you click add to portfolio, the “cash” will be available to use towards your trades.

2. Create Your Watch List

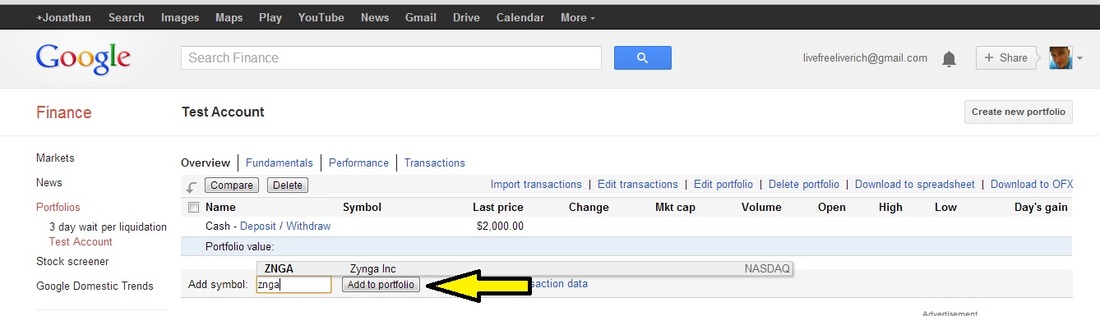

Figure 2-A

In the “Add Symbol” box, simply type the ticker symbol of whatever stock you wish to follow, and click “add to portfolio” button. For this example I added ticker symbol $ZNGA(Zynga), which is a company you may recognize if you have ever played any games through Facebook, like poker.

In the “Add Symbol” box, simply type the ticker symbol of whatever stock you wish to follow, and click “add to portfolio” button. For this example I added ticker symbol $ZNGA(Zynga), which is a company you may recognize if you have ever played any games through Facebook, like poker.

Figure 2-B

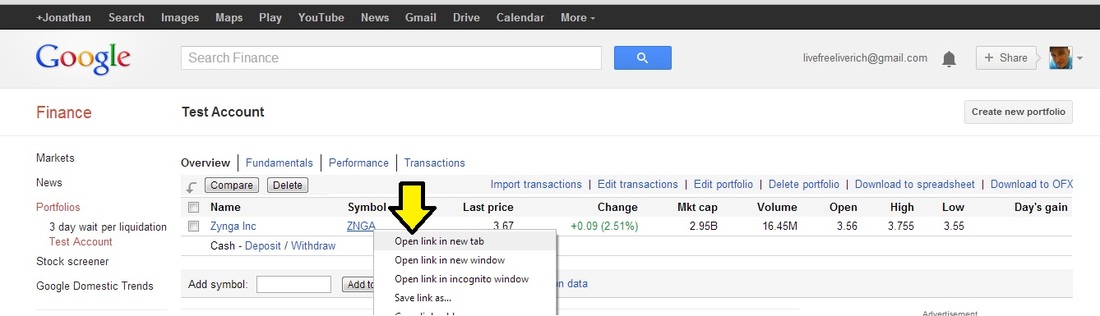

When I want to keep an eye on the chart of a particular stock from my list, I will simply right click the stock from my watch list and open the link in a new tab.

When I want to keep an eye on the chart of a particular stock from my list, I will simply right click the stock from my watch list and open the link in a new tab.

Figure 2-C

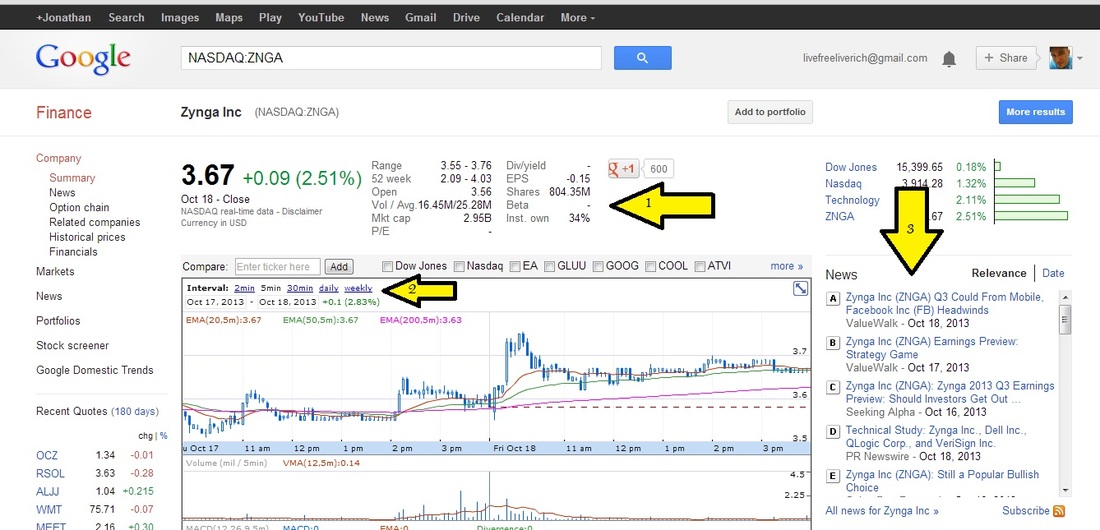

1. Here is all your basic fundamental information for the stock

2. “Intervals” is where you adjust the time frame for viewing the stock’s price pattern. Your options are 2min, 5min, 30min, daily, and weekly charts respectively.

3. I like to keep an eye on this news area, because it occasionally serves as an indicator for price action when new press releases emerge.

1. Here is all your basic fundamental information for the stock

2. “Intervals” is where you adjust the time frame for viewing the stock’s price pattern. Your options are 2min, 5min, 30min, daily, and weekly charts respectively.

3. I like to keep an eye on this news area, because it occasionally serves as an indicator for price action when new press releases emerge.

3. How to Record a Complete a Trade

Figure 3-A

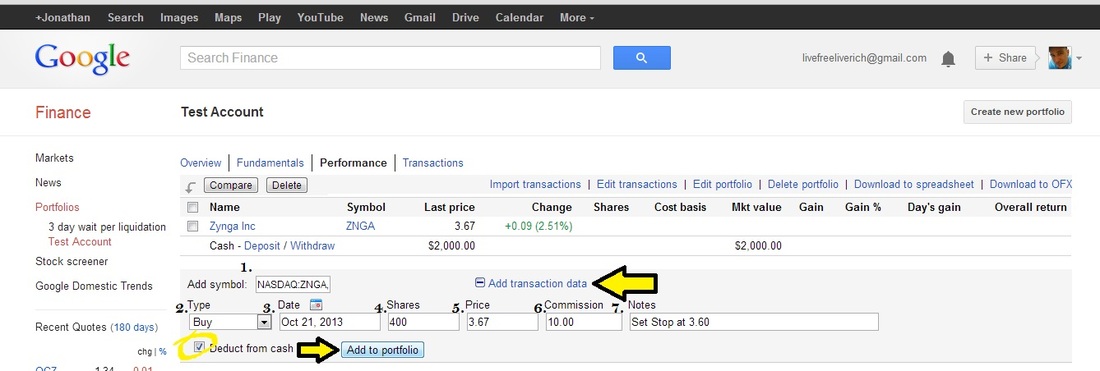

So you have been watching your list and have found a nice set-up pattern and want to take a position. Here’s how:

1. First enter the stock’s ticker symbol, from your list, into the “add symbol” box. Next click the “add transaction data” in the blue text

2. Type- choose whether your position is to buy shares or sell short

3. Mark the current date for your transaction record.

4. Enter the amount of shares you are buying or selling short

5. Enter the current price of the stock you are taking a position in.

6. Don’t forget to account for trading commissions. I used $10, because that is a basic online broker fee, but there are some that are cheaper.

7. Notes- I use the note section to decide, right when I take my position, what my stop loss would be set at. Google Finance does not have an automatic stop loss feature included with the app, so I watch what time I take my position, and if the stock price hits my stop loss price, then I sell or cover my shares at a loss. I don’t get discouraged, as I had no real money on the line, but rather use this as an opportunity to go back and review my trading activity to see if I could have analyzed the position differently or if there were indicators that were overlooked.

After filling out all the entry fields, just make sure you have “deduct from cash” checked off, and then click “Add to Portfolio” to start tracking your position on your portfolio.

So you have been watching your list and have found a nice set-up pattern and want to take a position. Here’s how:

1. First enter the stock’s ticker symbol, from your list, into the “add symbol” box. Next click the “add transaction data” in the blue text

2. Type- choose whether your position is to buy shares or sell short

3. Mark the current date for your transaction record.

4. Enter the amount of shares you are buying or selling short

5. Enter the current price of the stock you are taking a position in.

6. Don’t forget to account for trading commissions. I used $10, because that is a basic online broker fee, but there are some that are cheaper.

7. Notes- I use the note section to decide, right when I take my position, what my stop loss would be set at. Google Finance does not have an automatic stop loss feature included with the app, so I watch what time I take my position, and if the stock price hits my stop loss price, then I sell or cover my shares at a loss. I don’t get discouraged, as I had no real money on the line, but rather use this as an opportunity to go back and review my trading activity to see if I could have analyzed the position differently or if there were indicators that were overlooked.

After filling out all the entry fields, just make sure you have “deduct from cash” checked off, and then click “Add to Portfolio” to start tracking your position on your portfolio.

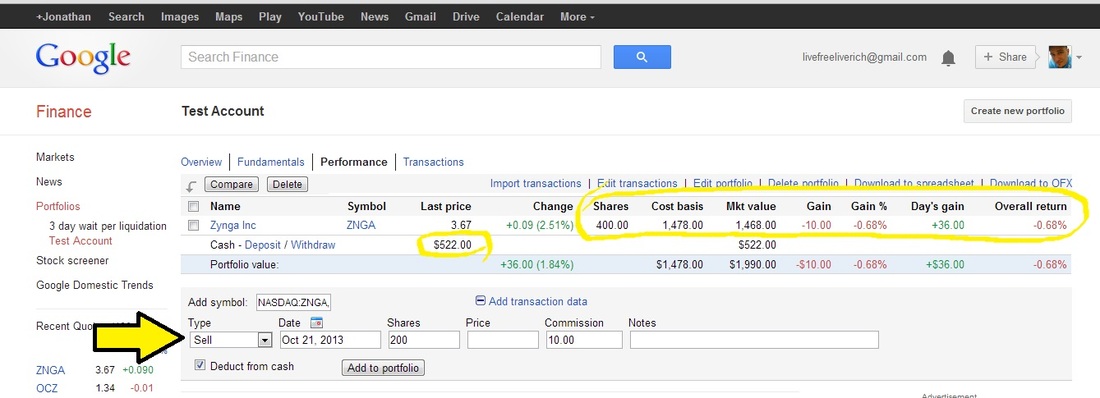

Figure 3-B

Your position will be added to your watch list for you to keep track of losses or gains throughout out the duration of your position based off real time/real life stock quotes! When you are ready to sell or cover your position you simply run through the same process from Figure 3-A, but you will be using a different transaction type. You may decide to sell/cover only a portion of your position, and you can just enter the specific amount of shares from your position. Congratulations! You’re one step closer to becoming the next Wall Street Warrior!

Your position will be added to your watch list for you to keep track of losses or gains throughout out the duration of your position based off real time/real life stock quotes! When you are ready to sell or cover your position you simply run through the same process from Figure 3-A, but you will be using a different transaction type. You may decide to sell/cover only a portion of your position, and you can just enter the specific amount of shares from your position. Congratulations! You’re one step closer to becoming the next Wall Street Warrior!